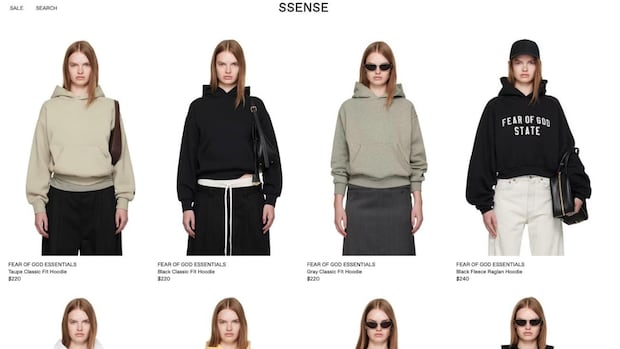

Montreal-headquartered online fashion retailer, Ssense, is set to seek bankruptcy protection following pressure from its primary lender to initiate a sale, a spokesperson confirmed in an email to CBC News. The company revealed that its primary lender has placed it under the Companies’ Creditors Arrangement Act (CCAA) protection to facilitate the sale. This protective measure shields the company from creditor-enforced bankruptcy and enables financial restructuring.

Ssense denounced the lender’s action, emphasizing that it was done without the company’s approval. The lenders involved in this move include Bank of Montreal, National Bank of Canada, Royal Bank of Canada, Bank of Nova Scotia (Scotiabank), and JPMorgan Chase & Co. CBC News has reached out to all lenders for comments, with the exception of BMO, which declined to provide a statement.

In response, Ssense is preparing to submit its own CCAA application promptly to secure the company, maintain control over its assets and operations, and defend the future of the business. The company stated that this process will offer the time and stability required for restructuring on their terms, safeguarding the interests of employees and partners, and emerging stronger in the future.

This development comes amid a challenging period for Canadian retailers, with Hudson’s Bay and Frank & Oak permanently closing their stores nationwide earlier this year. Ssense attributed part of its struggles to trade directives by U.S. President Donald Trump, particularly the removal of the U.S. de minimis exemption. This exemption previously allowed duty-free entry of packages worth $800 or less from Canada to the U.S., benefiting Canadian retailers with a substantial American customer base.

Retail strategist Lisa Hutcheson from Canadian consulting firm J.C. Williams Group highlighted various factors contributing to the vulnerability of retailers presently. Luxury brand-focused e-commerce companies like Ssense face competition not only from Canadian brands but also from global digital players. The demand for luxury brands has softened due to inflation and economic uncertainties. Additionally, preferences of Gen Z and Gen Alpha consumers for in-person shopping further impact the industry.

Hutcheson emphasized that financial challenges in the retail sector often result from a combination of operational difficulties, economic pressures, and market conditions. While there is optimism for Ssense, the company must strategize to reposition itself effectively in the volatile market landscape.

The news about Ssense was first reported by Business of Fashion on Thursday.